Pi cryptocurrency

You can find historical crypto market cap and crypto price data on CoinCodex, a comprehensive platform for crypto charts and prices. After you find the cryptocurrency you’re interested in on CoinCodex, such as Bitcoin, head over to the “Historical” tab and you will be able to access a full overview of the coin’s price history. Development of information systems For any given coin, you will be able to select a custom time period, data frequency, and currency. The feature is free to use and you can also export the data if you want to analyze it further.

Cryptocurrency is treated as a capital asset, like stocks, rather than cash. That means if you sell cryptocurrency at a profit, you’ll have to pay capital gains taxes. This is the case even if you use your crypto to pay for a purchase. If you receive a greater value for it than you paid, you’ll owe taxes on the difference.

Almost. We have a process that we use to verify assets. Once verified, we create a coin description page like this. The world of crypto now contains many coins and tokens that we feel unable to verify. In those situations, our Dexscan product lists them automatically by taking on-chain data for newly created smart contracts. We do not cover every chain, but at the time of writing we track the top 70 crypto chains, which means that we list more than 97% of all tokens.

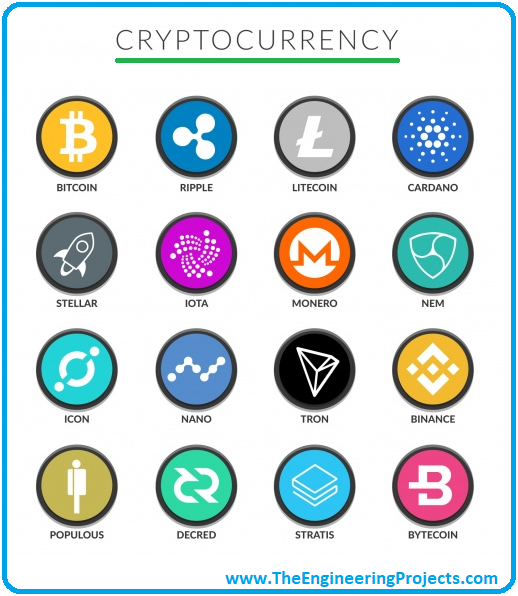

The very first cryptocurrency was Bitcoin. Since it is open source, it is possible for other people to use the majority of the code, make a few changes and then launch their own separate currency. Many people have done exactly this. Some of these coins are very similar to Bitcoin, with just one or two amended features (such as Litecoin), while others are very different, with varying models of security, issuance and governance. However, they all share the same moniker — every coin issued after Bitcoin is considered to be an altcoin.

Cryptocurrency bitcoin

De hashsnelheid is een cruciale barometer van hoe gezond de Bitcoin-blockchain momenteel is. Kort gezegd is dit een algemeen overzicht van de verwerkingskracht die op dit moment in het Bitcoin-netwerk te vinden is.

Een mempool is een register van alle BTC-transacties die nog niet zijn gevalideerd door een miner en toegevoegd aan het volgende blok op de blockchain. Een mempool wordt tijdelijk opgeslagen op elke individuele node op het netwerk en werkt als een soort van bufferzone of wachtkamer voor bitcointransacties die nog moeten worden uitgevoerd.

Dankzij de pionierende oorsprong blijft BTC aan de top staan van deze energieke markt, meer dan een decennium na het ontstaan. Zelfs nadat Bitcoin de onbetwiste dominantie is verloren, blijft het de grootste cryptocurrency met een marktkapitalisatie die in 2020 schommelde tussen de $100-200 miljard. Dit was voornamelijk dankzij de alomtegenwoordigheid van platforms die gebruikmaken van BTC zoals: wallets, beurzen, betaaldiensten, online games en meer.

Bitcoin has not been premined, meaning that no coins have been mined and/or distributed between the founders before it became available to the public. However, during the first few years of BTC’s existence, the competition between miners was relatively low, allowing the earliest network participants to accumulate significant amounts of coins via regular mining: Satoshi Nakamoto alone is believed to own over a million Bitcoin.

The total crypto market volume over the last 24 hours is $226.6B, which makes a 24.59% decrease. The total volume in DeFi is currently $9.37B, 4.14% of the total crypto market 24-hour volume. The volume of all stable coins is now $210.31B, which is 92.81% of the total crypto market 24-hour volume.

Newest cryptocurrency

After a decade of explosive growth, cryptocurrency has truly gone mainstream. Aside from the big, established names, new cryptocurrencies are launching almost daily. So let’s look at some of these coins and the process behind launching a new cryptocurrency.

In the early days of cryptocurrencies, initial coin offerings (ICO) were a popular way of bringing new tokens to market. Although this involved altcoins being sold to investors, this didn’t give them an ownership stake in the project. These days, security token offerings and initial exchange offerings are much more common than ICOs.

Following a lot of hype surrounding Aptos, it slumped in its trading debut. It has faced criticism over the allocation of its tokens, with nearly half allocated to investors, core contributors and the Aptos Labs foundation. This distribution of tokens, known as tokenomics, is a prime factor when assessing a new cryptocurrency.

Today, I would call BCH mostly a failure. My main takeaway: communities formed around a rebellion, even if they have a good cause, often have a hard time long term, because they value bravery over competence and are united around resistance rather than a coherent way forward.

After a decade of explosive growth, cryptocurrency has truly gone mainstream. Aside from the big, established names, new cryptocurrencies are launching almost daily. So let’s look at some of these coins and the process behind launching a new cryptocurrency.

In the early days of cryptocurrencies, initial coin offerings (ICO) were a popular way of bringing new tokens to market. Although this involved altcoins being sold to investors, this didn’t give them an ownership stake in the project. These days, security token offerings and initial exchange offerings are much more common than ICOs.

How to buy cryptocurrency

A hot wallet is a cryptocurrency storage application that is always connected to your computer and cryptocurrency network, and as such they tend to be more vulnerable to cybersecurity breaches and theft than so-called cold storage methods. Hot wallets are used to send and receive cryptocurrency, and manage tokens you possess. Hot wallets are linked with public and private keys that serve as security measures.

If you’d rather invest in companies with tangible products or services and that are subject to regulatory oversight—but still want exposure to the cryptocurrency market—you can buy stocks of companies that use or own cryptocurrencies and the blockchain that powers them. You’ll need an online brokerage account to buy shares of public companies like:

As compensation for spending their computational resources, the miners receive rewards for every block that they successfully add to the blockchain. At the moment of Bitcoin’s launch, the reward was 50 bitcoins per block: this number gets halved with every 210,000 new blocks mined — which takes the network roughly four years. As of 2020, the block reward has been halved three times and comprises 6.25 bitcoins.

A cryptocurrency exchange is a platform where buyers and sellers meet to trade cryptocurrencies. Exchanges often have relatively low fees, but they tend to have more complex interfaces with multiple trade types and advanced performance charts, all of which can make them intimidating for new crypto investors.

The most popular wallets for cryptocurrency include both hot and cold wallets. Cryptocurrency wallets vary from hot wallets and cold wallets. Hot wallets are able to be connected to the web, while cold wallets are used for keeping large amounts of coins outside of the internet.