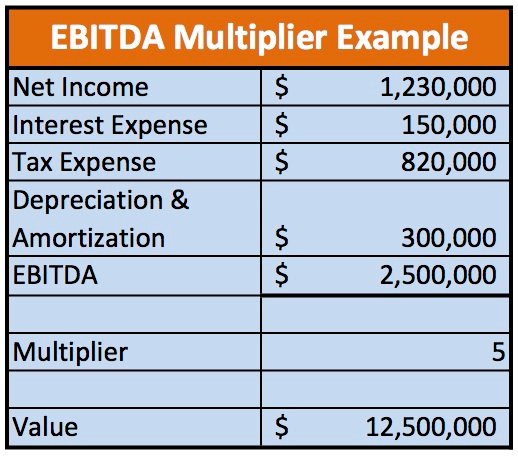

These individuals could be students looking for information, or even your competitors investigating your offerings. Tax planning tips for small businesses with NetSuite ERP NetSuite ERP streamlines business operations and improve efficiency by providing…

It is up to you to determine what makes a prospect “hot,” or qualified. Common qualifiers include a lead confirming they would like to learn more about your product, agreeing to a meeting, or asking for more information. In this section of your guided training material, we’ll build on what you’ve learned about leads and show you how they tie into your sales flow.

Lead Nurturing in Salesforce

Later, you find out that their “team” is only two people , they don’t have venture funding, they don’t have growth, and they don’t have customers. Spend this time on qualified prospects, and you’ll close substantially more valuable deals. The WBENC believe diversity promotes innovation, opens doors, and creates partnerships that fuel the economy. That’s why they not only provide the most relied upon certification standard for women-owned businesses, but they also offer the tools to help them succeed. Fundamentally, a survey is a joy for TTS agents who often have to survey a contact and escalate them to a full blown new business opportunity. TTS has been told by clients that typical phone based survey companies do not have agents anywhere near as skilled or who can manage higher end conversations.

- An effective presentation should deliver enough information to answer all the buyer’s questions adequately.

- A pre qualified lead is a potential customer who meets predetermined criteria deeming them a good candidate for your product or service.

- Yet it is better to know who is truly interested in what you are offering before using up resources and not getting any revenue from it.

- The first step to qualifying leads is to identify your target audience.

- Lead scores can also be calculated by computing your lead-to-customer conversion rate.

Check out this post to learn more about qualifying leads for the sale. When the lead changes hands from marketing to sales, the sales rep should have adequate information about the lead to help them close the deal. After speaking with the lead and building rapport, your marketing team will have some insight into their personality and buying habits. So, understanding how it works enables you to make use of effective pre-qualification methods not only to acquire quality leads but also to improve the business’s overall operations, productivity, and return. Instead of getting one CRM tool, it is much better to choose an all-in-one platform that helps you with prospecting, outreach, and closing. SalesBlink is asales outreachautomation suite that is one such platform that reduces the workload of sales teams tremendously.

About Salesforce

Building Your First florida income tax rate To Start Your Small Business After you’ve successfully fundraised for your business idea, you need… Ananya Prisha is an enterprise level Agile coach working out of Hyderabad and also founder of High Level PM Consultancy. Her goal has been to keep on learning and at the same time give back to the community that has given her so much. It gives excellent outcomes when you reach out to the right person. You will get your answer and if the lead has no authority, he will direct you to the decision-maker. When the answer to any of the above is a ‘No’, or the lead doesn’t reply to you at all, it means that the lead is not qualified.

The other type of pre-qualified leads are much higher in value. These are leads who take advantage of lead magnets that act as precursors to your product. They include free trials, demos, consultations and requests for quotes. Pre-qualified leads are warm leads that have shown interest in your products to the point that they seem much more likely to purchase them than the average lead on your list.

Nearly 12000 Miami Dade College Grads Will Earn Degrees in 2023 – news.mdc.edu

Nearly 12000 Miami Dade College Grads Will Earn Degrees in 2023.

Posted: Wed, 19 Apr 2023 16:12:09 GMT [source]

Also, 67% of sales are lost because sales reps cannot qualify leads before taking them down the funnel. If you don’t want to fall in that bracket, you have to involve yourself more in qualifying leads. With qualified leads, both marketers and salespeople can focus more time on prospects that are likely to convert. This saves the sales team from wasting time talking to people who will likely never become a customer and enables them to be more efficient and better equipped to close deals.

First, you need to learn about the two primary types of leads you can pursue. MLMLeadGenie.com generates fresh, responsive, and targeted MLM leads. At the time of delivery, leads are usually less than 24 hours old. Our commitment to quality is unparalleled and we have invested heavily in our patent pending AdMagic® software, which rejects fictitious content and captures true and valid leads. You can also visit our business Specialty/Response Lists for additional lists available.

Ways to Work with Pre Qualified Leads

The CHAMP technique suits situations where the leads are not aware of what your product or service is all about. Your sales team will be able to determine whether the product or service is suitable for the prospect or not. It helps disqualify the leads who don’t need the product or service. When you prioritize the highly qualified leads, your conversion rate is more likely to increase, and you will be working with customers who value your product or services. Accurate sales forecasting is crucial for making sound business decisions.

It provides those types of leads, as one will be eligible to wipe into a commercial source. In order to move potential customers to the next stage of your funnel or customer journey, you’ll want to reconsider how you are handling MQLs and SQLs. It cannot qualify leads who have not decided that they need to buy your solution. It suits those prospects where you don’t know who has the authority to confirm the purchase process. It is usually the case for startups where there are no well-defined processes. There can be instances when those who want to purchase your product or service do not need it.

- It is worth noting that there are actually very few companies out there who offer legitimate pre-qualified leads.

- This process serves the purpose of providing an efficient customer journey and ensuring the success of each sales campaign.

- Customer Portals and Channel Portals Through your web portal, you can exceed your customers’ expectations and create positive digital experiences.

- This is a huge opportunity for you to connect with your target audience.

- Our advanced business phone system lets you communicate with your customers, distributors, and agents.

- The first is do you have one person that is dedicated to sales or dedicated to inside sales or dedicated to marketing?

If there is a problem and it is worth solving, that means there is a need that you can fulfill. Web scraping works automatically to gather social data from websites. People can develop a referral program; every new customer they refer should offer a discount on their next purchase.

MQLs have higher potential to convert into paying customers compared to other leads. In order to accurately define an MQL, both marketing and sales teams need to collaborate to develop an effective definition that works for both departments. Quality conversations between teams can help ensure common understanding, driving better alignment and decisions on how to proceed.

Companies can use MQLs to understand which strategies and content offers to generate the highest-quality leads, ensuring their marketing and sales departments are in alignment. To make sure your message resonates with potential customers, consider using stylistic devices such as metaphors, similes, personification, or alliteration in your content. Qualifying marketing leads, a process that is essential for businesses, helps sales teams focus their efforts on prospects that are likely to become customers. This process serves the purpose of providing an efficient customer journey and ensuring the success of each sales campaign.

Startup Guide

They may realize this eventually, and as a result, you have to face rejection or negative reviews if they go ahead with the purchase. When you see that a prospect has a high score on your CRM software, it doesn’t automatically mean that they are the right leads. Know who you should get in touch with before you invest your time, money, and efforts.

New York State News – Rockland County Business Journal

New York State News.

Posted: Sat, 22 Apr 2023 06:00:54 GMT [source]

Every business is interested in receiving more Opportunity Leads because Leads are critical to the growth of a company. Do what it takes to grow your company today by choosing some of our extensive Lead Lists that are going to fit the needs of your particular business. Often this means capturing a name or buying a name that becomes a work in progress. You make it hard for everyone else and please leave until you learn some manners. They are the reason why the biz opp field is so slimy and why people get turned off by it. • Use a service like Melissa Data to verify the correct address and phone number of the MLM Leads Lists purchased.

What are the concrete steps they will be taking to get what they want? Providing your lead with the tools to create a solid plan is vital in the lead qualification process and it can help them see the value of your product or service. If there is one thing that every MLM network marketer strives for, it is generation of or purchase of pre-qualified leads.

The causes and consequences of the missing immigrants – minneapolisfed.org

The causes and consequences of the missing immigrants.

Posted: Mon, 17 Apr 2023 15:47:37 GMT [source]

An MQL is someone who has expressed interest in a product/service but is not yet ready for direct personal attention from sales. An SQL is further down the funnel, ready for follow-up from sales, and should take priority over MQLs in terms of engagement. Marketing-qualified leads are prospects who have demonstrated an interest in your product by engaging with your marketing efforts.