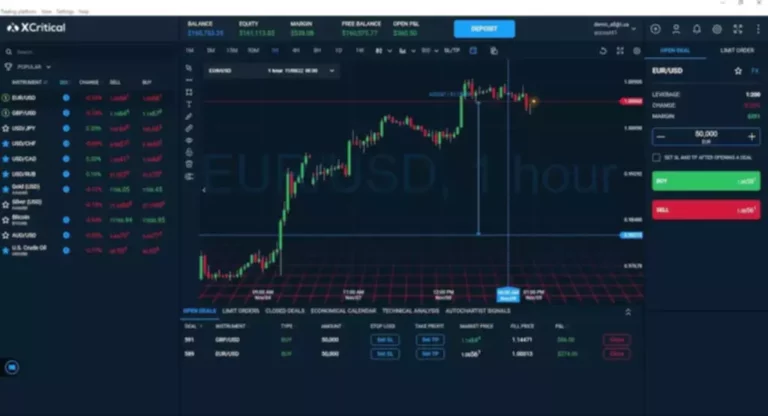

Salesmate has a support portal through which you can access useful video tutorials, search the help center for answers to common questions and use the community forums. As for live support, there is a 24/5 (Monday through Friday) chat option and a website contact form. I noted that the format of the boards felt similar to what I’d https://www.xcritical.com/ used in monday.com’s work management setup; if you are familiar with using other monday.com products, then the CRM side will feel very straightforward.

Best for Project Management and Sales

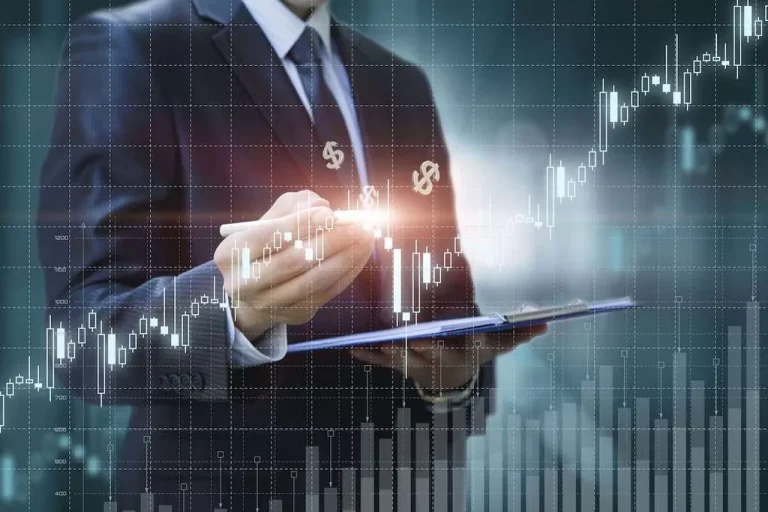

Higher plans introduce more detailed sales management tools like sales forecasting and automated workflows, which is beneficial for businesses scaling their operations. Despite its starting price of $29 per user per month (billed monthly) which is not the most competitive, I find that Salesmate CRM is a good value for price. It is a scalable solution, with a good amount of sales, marketing and forex broker license management tools available with each plan, with the right balance to make upgrading make sense as your company grows and needs change.

Best practices of sales pipeline management

Additionally, you can get help through Zendesk’s AI chatbot, which can help direct you to knowledge base articles, connect you to an agent or help you submit a support ticket. The live agent I chatted with was pleasant and helped me solve a technical issue, and the help by email, which took about three hours to receive, was also top quality. I tested how it recorded interactions, noting the ease with which one could replay and analyze calls. This functionality suggested it would be useful for teams needing detailed records of customer interactions for compliance or quality assurance purposes. After submitting a question through the chat tool, I received an answer to my question in just a few minutes. Your experience may vary, of course, but my time with the support team was pleasant.

Best CRMs for Commercial Real Estate Brokers

Throughout her career, Teajai has held marketing leadership roles in various sectors, including healthcare, e-commerce and construction. Her areas of expertise encompass content creation, social media strategy, search engine optimization (SEO), email marketing and customer relationship management (CRM) implementation. Teajai’s educational background includes degrees in business administration, psychology and management, providing her with a well-rounded foundation for her marketing career. With her track record of success and deep understanding of digital marketing, Teajai continues to be a sought-after expert and thought leader in her field. It gives detailed permission settings and plenty of customization options, allowing you to adapt the system to various business requirements. Support options across all plans include email, phone and chat 24×5, ensuring help is readily available during business hours.

Key Features to Look for in a CRM for Commercial Real Estate Brokers

As they expand, managing a growing list of leads and customers manually can become overwhelming, leading companies to miss out on sales opportunities. A CRM offers efficiency and data storage tools that make managing large lead and customer lists easy. It comes with many of the key features needed to maximize your sales funnel without leaving any extra money on the table.

I tried all three communication options and was happy with my experience. The phone staff were polite and email response times were satisfactory at just under eight hours. Additionally, Freshworks Academy teaches you the ins and outs of how to use its tools, and there’s even a certification.

- You can reach them seven days per week between the hours of 8 a.m.

- I find that it is well-designed with a modern and intuitive interface, making it easy for new users to hit the ground running.

- It’s powerful and versatile enough to suit the needs of various business sizes and industries with its vast feature set and large integration library.

- What’s more, it offers a free CRM plan so small businesses can test the waters without a financial commitment.

- As good as the product is, it’s also known for getting buggy at times.

- I appreciate that Salesforce encourages customers to reach out with negative or positive remarks, as both are useful for improving future service.

While the majority find it to be easy to use and feature-rich, offering everything they need out of a CRM, there are a handful of users that give it low marks for poor customer service experiences. Customer relationship management (CRM) software helps businesses increase sales, drive growth and provide exceptional customer experiences. There are many CRM platforms on the market, each with its own set of features and benefits. To help make your research easy, we’ve created a guide to the best CRM for small businesses available today.

However, if you’re new to its boards and organizational setup, it could take some getting used to. Salesforce is reachable by phone or chat; if it is more convenient, you can request a callback later. I appreciate that Salesforce encourages customers to reach out with negative or positive remarks, as both are useful for improving future service. Cloud based advanced CRM solution for business brokers and M&A advisors. Data migration is another critical step—ensure your existing data is accurately transferred to the new system, maintaining data integrity and minimizing disruptions. Setting up integrations with other tools and platforms your brokerage uses is essential for creating a cohesive technology ecosystem.

The costs of real estate CRMs vary and can cost anywhere from $11 per month to more than $1,000 per month. Most options have a free trial that lets you test-drive whatever solution you think might be the best fit for you. Finding the right CRM software the first time is important, especially as some providers—such as HubSpot—may require you to sign up for an entire year at a time. As you weigh your options, consider factors including available features, ease of use, customer service and overall value. If you need a platform you can expect to work consistently while meeting your business’s basic needs, Pipedrive is an ideal option. While it doesn’t have the most robust feature offerings, it’s reliable and offers a package for every budget.

After firing off an email, I received a reply with tips on how to solve my problem in 26 minutes. Bitrix24 offers multiple views to see data, including lists and Kanban boards. You can integrate many other business software solutions with Agile CRM.

When shopping for a CRM, be sure to look for providers that offer the must-have features for your specific industry and needs. In many instances, there may be CRMs that are designed to meet the needs of your industry, which helps you hit the ground running. While Nimble has an oddly low number of reviews on Trustpilot, it has nearly 2,000 reviews on Capterra with an overall score of 4.4 out of 5 stars. Reviewers frequently comment on its quality features, intuitive design and time-saving tools for salespeople. On the other hand, some users say it’s too expensive, which is something that I would agree with—especially given its low storage limit and lack of unlimited contacts. Pipedrive has a solid 4.4 out of 5-star rating on Trustpilot from nearly 2,000 users.

We do this by bringing together best-in-class technology, cutting edge tools, industry content, four generations of industry knowledge, a team of experts, and a passion to advance the profession. Zoho CRM is a good all-around choice for the average small business seeking a versatile yet user-friendly CRM with affordable pricing. Effective implementation of a CRM requires that your entire team is on board and comfortable using the new system. Conduct training sessions to familiarize them with the CRM’s features and best practices. Encourage team members to ask questions and provide feedback to ensure a smooth transition and maximize the CRM’s benefits for your brokerage firm. Our websites are designed to convert and deliver everything you need as a business broker.

HoneyBook offers 24/7 customer support by email and phone, with differing contact options available if you need to connect with sales, customer service or the security team. There are also self-help options available through the website’s help center. There is a live chat feature available during the hours of 4 a.m.

Insurance brokers might prioritize policy management and client renewal reminders. Tailoring your CRM to your specific needs ensures it supports your business processes efficiently. CRM software does the heavy lifting of managing your relationships with your customers or clients. Common features include workflow automation, email and text automation, reporting and analytics, task management and a template library that allows you to create your own custom documents.

Agile CRM uniquely offers behavior-based segmentation and it automatically tags and scores leads based on distinct activities, such as email interactions and website visits. This feature allows small businesses to strategically pinpoint the right audience segments, thus reducing the waste of resources on poorly targeted marketing campaigns. Salesforce has a bad rating on Trustpilot of just 1.2 out of 5 stars from over 400 users. I certainly find it odd that such a large company with an arsenal of software products only has 400 reviews. Interestingly, 84% of reviewers gave it a 1-star rating, with many commenting that it is slow and cumbersome to use and that its customer service needs improvement.

To test drive plan features, take advantage of the free 14-day trial. Pricing starts at $25 per month when paid annually and goes up to $300 per month for the Unlimited plan. There are add-ons to extend the functionality of your Salesforce solution as you grow, which makes it a great option for companies that want to stick with the same CRM provider at all stages of growth. When it comes to ease of use, I have mixed feelings about the monday.com CRM. On one hand, its modern and streamlined, but on the other, it can feel complicated to set up as not all features and functionalities are obvious.

These allow for hands-on configuring of your CRM, consulting, data migration, custom apps and more. While Zendesk Sell has no free plan, its trial lets you test out each plan level, including its highest tier with task automation, prospecting, sales forecasting, goals tracking and deal scoring. For a CRM to lock its deal scoring behind its most expensive plan is unusual—some offer lead scoring for free. When testing Zendesk Sell, I focused primarily on its capability to customize up to 20 sales pipelines. This feature allowed me to experiment with different configurations to see how well the tool could adapt to varied sales processes.