The forex market is a fast-paced and dynamic environment where traders aim to capitalize on the fluctuations of currency prices. To make informed trading decisions, it is important to have access to various technical indicators that provide valuable insights into market trends and potential price movements. One such indicator that is widely used by forex traders is the momentum indicator.

Traders also use the 80/20 rule, which states that an asset is overbought when the stochastic oscillator is above 80 and oversold when it is below 20. Traders can adjust the RSI settings to suit their trading style and the asset they are trading. Shorter periods, such as 14 days, are better suited for day traders who want to take advantage of short-term price movements. Longer periods, such as 50 days, are better suited for swing traders who want to identify longer-term trends. When the line is above the zero line, it indicates that the price is gaining momentum and the trend is likely to continue. Conversely, when the line is below the zero line, it indicates that the price is losing momentum and the trend may be weakening.

Understanding the Forex Momentum Indicator: A Beginner’s Guide

A trader can employ several different entry strategies with the momentum model. The simplest is to take a market long or market short when the model flashes a buy or a sell signal. This may work, but it often forces the trader to enter at the most inopportune time, as the signal is fx choice review typically produced at the absolute top or bottom of the price burst. Prices may continue further in the direction of the trade, but it’s far more likely that they will retrace and that the trader will have a better entry opportunity if they simply wait.

Trading the Pivot Points

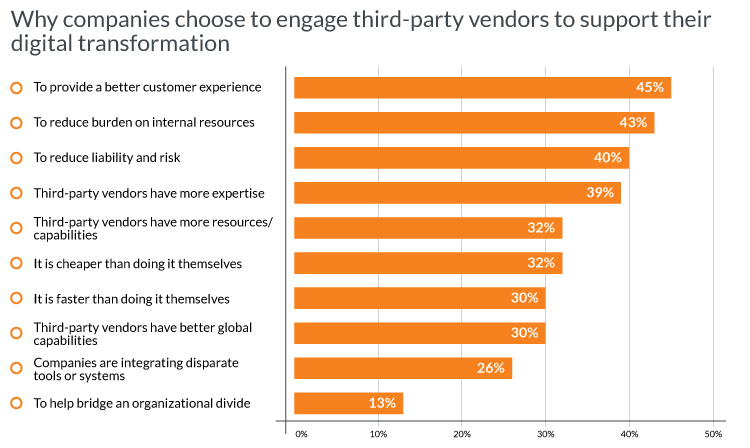

Aside from trading when the price reaches the ranges between +/-100, traders use the CCI to identify extremely overbought and oversold zones with boundaries at +/-200. Below is our take on some of the most popular momentum indicators available on the Capital.com platform, and how one could incorporate them into their trading strategy. This information can be used to confirm a trend and determine when to enter or exit a trade.

Momentum indicator trading strategies

For example, traders are advised to avoid using a momentum indicator suited for sideways markets when a market is trending. Elliot Wave Theory (EWT) is a popular method of technical analysis that helps traders predict… As I said above, just comparing how many bullish vs. bearish candlesticks you have and how strong they are, you can gain a deep understanding of price charts. By the way, this is also what indicators like the RSI or the Stochastic do.

However, although this set-up may indeed offer a high probability of success, it is by no means a guaranteed money-making opportunity. Not only will the setup sometimes fail outright by producing false signals, but it can also generate a losing trade even if the signal is accurate. Remember that while momentum indicates a strong presence of trend, it provides no measure of its ultimate potential. In real estate, month-over-month figures provide a measure of rate of change, which is what the study of momentum is all about. Different momentum indicators indicate different things – for example, when the RSI scores above 50, that signifies positive momentum, which can be indicative of an uptrend in the market.

Build your skills with a risk-free demo account.

- TradingPedia.com will not be held liable for the loss of money or any damage caused from relying on the information on this site.

- Once the MACD segment is established, you need to measure the value of the highest bar within that segment to record the momentum reference point.

- It calculates the difference between the current closing price and the closing price of a certain number of periods in the past.

- When the momentum indicator generates a signal that aligns with the direction of the trend line, it strengthens the validity of the signal.

- This oscillation of the MACD around the nine-period line was first plotted into a histogram format by Thomas Aspray in 1986 and became known as the MACD histogram.

Traders can use the RSI to identify potential support and resistance levels. When the RSI breaks through a resistance level, it may signal a potential uptrend. Conversely, when the RSI breaks through a support level, it may signal a potential downtrend. There are many types of momentum indicators, but some of the most commonly used in forex trading include the Relative Strength Index (RSI) and the Stochastic Oscillator. A new momentum swing low or high is usually created when price makes a sudden and violent move in one direction.

The momentum indicator is a technical analysis tool that measures the rate of change of a currency pair’s price. It helps traders identify the strength and speed of price movements, which can be crucial for trend analysis. The momentum indicator is displayed as a line on a separate chart below the price chart, with values above and below a centerline. To conclude, the momentum indicator is a valuable tool for forex traders, especially beginners, as it helps identify trends, measure their strength, and pinpoint potential reversal points. By understanding how to interpret and use the momentum indicator, traders can make informed trading decisions and enhance their chances of success in the forex market. However, it is important to remember that no single indicator can guarantee profitable trades, and traders should always perform thorough analysis using multiple tools and techniques.

Momentum indicators are meant to help traders spot whether the market trend will continue or reverse. As you can see, momentum analysis is a great way of looking at charts and it should be used by all traders, regardless of their style. Momentum analysis, though, is one of the most important skills any trader can learn. If one is to connect the tops and the bottoms of the Momentum indicator, he/she will be able to place trend lines.

When the RSI exceeds the 70 mark, that can indicate an overbought market. Conversely, RSI numbers below 50 can point towards downtrend momentum, and values below 30 can potentially mean the market is oversold. The equation compares the last closing price to a previous closing price from a set number of periods ago. The Relative Strength Index (RSI) is the most commonly used momentum trading indicator.

On the left, the price was going up strongly without any bearish interference and the sellers never had any chance to move lower. After the price rose into the blue zone, things changed and now the bearish candles become much stronger and longer. When the RSI is above 70, it is considered overvalued, indicating that a price correction may be approaching. In other words, we may be relatively certain of the direction of the move, but not of its amplitude. As with most trading setups, the successful use of the momentum model is much more a matter of art than science.

They are called “momentum” indicators as the principles behind price movements are similar to the ones used to calculate speed, momentum, and acceleration. In this case a trader needs to identify potential overbought and oversold levels, based on historic values of the indicator. After he/she has identified the two extreme levels, the next step is to make sure that at least two-thirds of previous Momentum readings occur between these extremes. It is important to note that the momentum indicator is not a standalone tool and should not be used in isolation. Like any technical indicator, it has its limitations and can generate false signals.

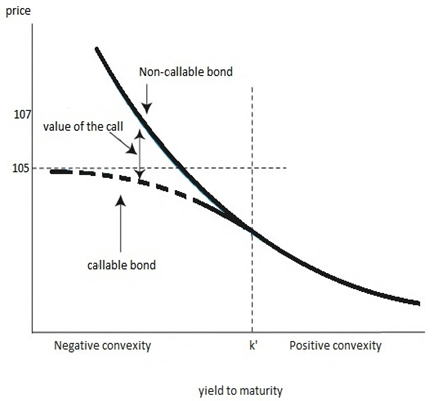

If two momentum indicators show the same thing, it could give the trader more confidence to take the trade. To add strength to the crossover signals, traders will use both the EMAs and the histogram. In addition, traders use price crossing over the zero line for bullish or bearish signals. The generally understood trigger for trades using the MACD is when the signal line crosses the histogram (crossover). This can be interpreted as a change in the market’s momentum, which could lead to a change in the price trend.

Although the histogram is in fact a derivative of a derivative, it can be deadly accurate as a potential guide to price direction. Here is one way to design a simple momentum model in FX using the MACD histogram. Your selection of momentum indicator should depend on your trading strategy and investment goals. It is essential that you do your research before making an investment decision.

Usually momentum starts to shift before the price does, thus, it can be considered as aafx trading review a leading indicator. What can be simpler than taking the current close, dividing it by the close of x bars ago, and multiplying by 100. You get to see at a glance the amount and speed by which prices have changed from x bars ago.